It’s a fair bet that 2016 will be the year of ever more ambitious collaborations between traditional media and digital disrupters. We have seen the Alibaba and Jeff Bezos acquisitions of the South China Post and the Washington Post respectively, the Axel Springer buy-out of Business Insider, and legacy media investments in BuzzFeed, Vox, and Vice News. These will surely be followed by a new wave of deals and collaborations. But with a difference.

“Old brands in new hands”

Acquisitions, mergers, joint ventures and alliances can always be catalysts in digital transformation. But, regardless of who is buying whom, traditional media must increasingly pass the task of reinvention to ‘digital-youth’. As a result, some acquisitions – especially by newspaper-centric groups – may come to resemble reverse takeovers. “Old brands in new hands” might just become the media theme of 2016.

It may also be the year of seismic disruption in free-to-air television. After several years in which falling audiences have been camouflaged by bounce-back advertising revenues, broadcasters have been lulled by the reassurance of “only” gradual decline. But the on-screen convergence of online and broadcast programming by Apple, Roku, Amazon and others will start to undermine the traditional power-base of mainstream TV: large audiences simultaneously watching programmes and advertising. Such linear TV has already been stealthily eroded by ‘time-shifting’ and catch-up viewing. But the march of Netflix, Amazon Prime and Apple will now take online viewing towards the tipping point.

Those broadcasters which have invested strongly in programme production (like the UK’s revitalised ITV) will not, of course, be killed off by online convergence. But they will have to change. In many countries, broadcasters still benefit from large audiences watching single channels for whole evenings without switching. Such habits will, ultimately, be washed away by technology which multiplies viewing choice and encourages loyalty not to mass market channels but to programmes and genres.

Meanwhile, online viewing will accelerate the move towards content marketing TV in which major brands increasingly divert promotional spend into the funding of sponsored programmes, product placement or even their own channels. Watch the way that WPP, the world’s largest marketing group, is investing in content, both on behalf of clients and on its own account. That’s another challenge for advertising-dependent free-to-air broadcasters.

Online-broadcast convergence will comprehensively disrupt television. But it will also give broadcasters the fresh opportunity to compete for the millennial audiences they have been losing. As The Verge summarised viewing in the US: ” This year, streaming platforms positioned themselves as stand-alone platforms rather than ones that complemented a cable subscription… And it was the year stodgy old networks began to see these platforms as a real threat. This year, Netflix and Hulu proved they can do television as good as — if not better than — cable. And, as cable channels like CBS, NBC, and Discovery have already proven with the launch of their own subscription streaming services, next year will be the year television definitively starts copying Netflix.” (www.theverge.com)

As elsewhere in legacy media, the future of these broadcasters may depend on their choice of partners.

News brands

Global grab

Following the 2015 investments in Vice News (by Disney, Hearst, and NBC Universal), Vox (NBC Universal), Business Insider (Axel Springer) and BuzzFeed (NBC Universal), we should expect traditional media to splash out even more on digital news brands in 2016. US telco Verizon, which

bought AOL for $4.4bn in 2015, might – despite its denials – decide to sell Huffington Post to one of the news brands that would have most to gain from its worldwide (but not yet profitable) franchise. What price News Corp, Axel Springer, Time Warner or Naspers?

Predictions: Huffington Post and also BuzzFeed will be bought by traditional media players. Australia’s Fairfax (Sydney Morning Herald and The Age) and the UK’s Express (owned by OK! owner Richard Desmond) and Independent newspapers (the Lebedev family) will be acquired by digital and/or retail entrepreneurs. The revitalised Trinity Mirror, which recently became the UK’s consolidator-in-chief of regional papers, will surely divest its Mirror national dailies – and develop/acquire radio and TV as part of its local franchises.

CNN for sale?

The 35-year-old global TV news network CNN may have made record profits of some $600m in 2015, and may reach $1bn by 2017 on the strength of its long-term cable subscriber deals. But the network’s recent 10% staffing cuts tell another story of parent company Time Warner’s determination to streamline its whole sprawling cable business. The catalyst was TW’s decision to rebuff 21st Century Fox’s takeover bid and the subsequent failure to secure a merger with Comcast. The company must now prove to investors it did not make a mistake. What better way than to secure a high price for CNN, a company that is soundly-profitable but distinctly non-core – and facing digital disruption?

That’s the context for a possible $6-9bn divestment. It’s not a new idea because the bidder Fox had planned to sell CNN, to avoid regulatory conflict over Fox News. Potential US buyers are CBS and Walt Disney’s ABC and there would also be international bidders.

However, CNN’s whole profitability is based on its bundling with other TW-owned Turner cable channels. It makes money from advertising and also by charging cable companies to carry the channel. That structure – and the way that the charges to cable companies have been increasing steadily – may encourage Time Warner to cash-in, ahead of future disruption to CNN’s rich business model. One possible alternative to outright sale would be the formation of a multi-platform global news alliance in which Time Warner would retain a stake it could sell-down over time. The possible partners could be as diverse as Huffington Post, the New York Times, Bloomberg, Axel Springer – or even Murdoch’s News Corp (as distinct from Fox and Sky News).

Prediction: CNN will be floated off, sold or merged into a global news group.

Newspapers to go un-daily?

The fact that the UK’s still substantial national daily newspaper market is wholly funded by the magazine-rich, premium-priced weekend editions has provoked even more discussion about why these 100-year-old news brands don’t start to reduce frequency. 2016 may be the year when one or more publishers dares to try. And newspaper publishers everywhere will be watching intently.

Daily Mail shake-up?

The Daily Mail & General Trust (DMGT) – founded 120 years ago by mercurial tabloid pioneer Lord Northcliffe – has long been one of the UK’s most successful media groups. It has developed an impressive light touch to managing acquisitions and start-ups. This is the company that founded and still controls the 47-year-old, £1.2bn Euromoney financial information group. DMGT’s pre-emptive UK free daily Metro has become the most profitable of a genre which is owned everywhere else by Sweden’s Metro International.

It also launched MailOnline which has built an online audience of more than 200m monthly uniques, not so much for the Daily Mail content as for its celebrity gossip. Along the way, DMGT has had decades of publishing the strident mid-market Daily Mail, the UK’s most profitable newspaper.

But this is also the UK public company whose current CEO acquired, launched and developed what has become one of the most successful B2B information, consulting and events groups. Today, DMGT’s profits are 75% derived not from the Mail newspapers but from B2B, including “the world’s largest catastrophe modelling company”, the US-based Risk Management Solutions.

Although the voting shares of DMGT are family controlled in a Murdoch-like way, investment analysts have started to whisper about the way that the current chairman Lord Rothermere’s fortune would be hugely enriched by de-merging the newspaper-centric assets. He was happy to de-merge his online property interests into the separately-listed Zoopla and his Wowcher coupon business into a private equity-owned company. But newspapers are his company’s history.

Whether the attitude changes might depend on other areas of the company’s performance. These are testing times, with the long-term stability of Euromoney rocked by the collapse of print advertising and financial market consolidation; the advertising slow-down of MailOnline just as it was set to become profitable; and the inexorable decline of the Daily Mail itself. These are important pressure points.

While DMGT has never seemed to lack investment firepower, it is clear that one of its current strategic opportunities is to grow its sub-scale but highly-profitable exhibitions subsidiary. It may now be interested in acquiring the events owned by Ascential (formerly EMAP and Top Right Group), Informa, Penton, or even Reed Elsevier’s world leading exhibitions group. But those deals would not be easy for this family-controlled media conglomerate with interests right across B2B and B2C.

It is significant that Rothermere has refused to rename DMGT to recognise even the role of B2B in his group, let alone its primacy. That sentimental attachment to his inheritance may make it similarly difficult for him to sell-off or de-merge his national newspapers. But the fact that the company’s shares ended 2015 some 25% below the year’s high – twice as bad as the London stockmarket – is a reminder that the economic case for reorganisation, rationalisation or de-merger may yet become overwhelming. The DMGT chairman might just be reminding himself of how – having reportedly once turned down a £1bn offer for his regional newspapers – he was, ultimately, forced to accept a price at least 75% lower.

The first signs of strategic change could be one or more of the following decisions: merger of MailOnline into an existing digital operation; management separation of Metro from the paid-for Daily Mail; integration of the still separately-quoted (but 73% owned) Euromoney into DMGT. Or the outright sale of all newspaper-centric interests.

In 2014, DMGT sold its online jobs sites to Axel Springer. The revitalised German company – with its shared newspaper history, digital success, global strategy, and family control – looks like an obvious long-term partner for the heirs of Lord Northcliffe. Perhaps we will see that in 2016.

Prediction: DMGT will ‘divest’ its news brands including MailOnline into a semi-separate business in 2016-17.

Magazines

Bauer turns on radio

Bauer is the world’s largest magazines group with print-centric operations across Europe, the US, and the AsiaPacific. But revenues and circulations are sliding fast, not least in the UK and Australia where the bulk of operations were bought in a billion-pound investment spree over the past decade.

It is believed that the UK magazines bought from EMAP for £700m may now not even be profitable. One-time cashflow of £70m from brands like Heat, FHM, Closer, and Motorcycle News has all but evaporated in eight years of Bauer ownership. And the company’s struggling Aussie company (formerly Kerry Packer’s ACP Magazines) is about to have its third CEO in two years.

These are the headaches of Yvonne Bauer whose fifth generation leadership of the family firm has so far been marked by pricey acquisitions – and that from a company which had previously created almost everything it owned.

Insiders remember Ms Bauer’s euphoric disclosure that the once so private company had “arrived” in the magazine mainstream by securing the German licence for Cosmopolitan. The breathless announcement – after decades of high-profit Bauer success from publishing puzzles, competitions and real life stories – came amidst the company’s untimely splash into global magazines.

As if to demonstrate its new-found expansiveness, the famously-secretive Bauer adopted its first corporate slogan: “We think popular”. Insiders joked that the company was thinking popular while its magazines were becoming unpopular. But it’s not all bad. Bauer’s UK radio (bought for £400m, also from EMAP) has been booming, and has motivated further investment across Europe where the company is now second only to Bertelsmann-owned CLT.

Expect further Bauer radio investments in Australia (where it is being widely tipped to buy Southern Cross Austereo) and in Europe. But how long before this push into broadcasting and music leads to a sell-down in magazines – or, at least, to sharply reduced print operations?

Prediction: Bauer will start to sell-off magazines – especially in the UK, Australia and the US – and buy more radio stations in Europe and the AsiaPacific.

Time Inc ‘merger’

It is 18 months since Time Warner pushed Time Inc onto a reluctant stock market. Despite the company’s investment in digital media and events and its money-saving relocation from an iconic New York headquarters, Joe Ripp’s energetic team is pushing water uphill. Time Inc’s share price has lost 27% since the IPO. Meredith (which is widely tipped as a suitor) has held steady and now has a market value 15% higher than its legendary rival. It has been widely reported that tax issues created by the Time Warner divestment would prevent any kind of Time Inc merger or sale before 2016.

The chances of a break-up of the world’s best-known magazine company have been increased by activity in the UK (formerly IPC Media) where the company has sold its Thames-side headquarters. And it is relocating smaller, special interest magazines out of London.

So, perhaps, the first big divestment will come in the UK. That might hasten the ‘merger’ of Time Inc with Meredith – the women’s interest tv-digital-print media group whose own $2.4bn acquisition by broadcaster Media General (MG) is up in the air. The MG deal, if it went ahead, might anyway involve the de-merger of Meredith magazines – and the opportunity for a Time-Meredith combination. And, in the wings, are Hearst and Conde Nast. The catalyst for a Time Inc break-up may also be News Corp’s apparent appetite for the legendary but problematic Time, Fortune and Sports Illustrated. Or even for the whole company.

Prediction: Time Inc will cease to be an independent company in 2016-17.

Immediate Media deal?

The Exponent UK private equity-owned Immediate Media (formerly BBC Magazines) is generating some £30m of cashflow annually from revenues of £160m. The company describes itself as a “special interest content and media platform business” but there is a bit more to it.

This is a story of a tech-savvy, specialist magazine-media company whose £121m buy-out deal from the BBC reflected an ironic discount for the 50% of revenues derived from a legendary TV listings magazine called the Radio Times. The sceptics who let Exponent buy the UK’s most profitable magazine on the cheap did not understand that it was a brand with a difference. During Immediate’s first four years, Radio Times has become the country’s best-performing major magazine, with a cover price that has doubled at the expense of only 25% of copy sales. Wow!

The gains have been used shrewdly to fund the expansion of digital and e-commerce operations. Even now, what is the world’s oldest listings magazine may account for some 60% of profits. But that almost obscures the rising value of its specialist consumer portfolio of more than 60 magazine, web and events brands. Immediate has 16m readers-users spread across sports, crafts, gardening, motoring, music and food. The portfolio now includes some fast-growing e-commerce.

Immediate’s 1.1m posted subscriptions makes it much more of a database business than most UK magazine-media companies. Consequently, it has fared better with e-commerce than its newsstand-oriented competitors. It has – uniquely – also managed to secure a share of ‘lifetime’ revenue, even on so-called ‘affiliated’ deals when the media company itself is taking no risk of unsold stock.

Now, Exponent is preparing for a big payday. The best deal may still be a reverse takeover – and, therefore, a ready-made IPO – for the £60m-turnover smart but struggling media-tech Future Plc. On the other hand, a deal with Time Inc UK may just help Immediate management ramp up its scale and profitability – to improve next-step IPO or auction opportunities. The company’s recent acquisition of 24-hour TV shopping channel Jewellery Maker signals a new area for growth – and also perhaps helps identify QVC, the US-owned shopping TV behemoth as a possible suitor.

Predictions: The UK’s most e-commerce magazine-media group Immediate Media will be ‘merged’ either with Future Plc, a part of Time Inc UK – or an online retailer. Or even the Daily Telegraph Group with its wealth of ‘reader offers’ e-commerce – and owners shared with UK online retailer Shop Direct.

Content marketing

In magazines, the seemingly successful launch of Porter by Net a Porter and the use of magazines by digital operators like Airbnb, demonstrates the complementary power of print. It suggests that 2016 will see retailers and others ‘acquiring’ established magazine brands as ready-made vehicles for content marketing. Whole magazine franchises or ‘special editions’ could become sponsored over the long-term. It’s an opportunity for magazine-media companies to capitalise on the rapid growth of sponsorship and native advertising and to turnround the profitability of some much-loved but depressed brands.

Prediction: Some established magazine brands will become long-term vehicles for content marketing – in print and digital.

Television

UK up in the air

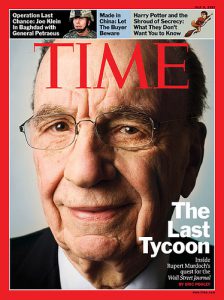

2016 may be the year of total change in UK TV. Expect Rupert Murdoch’s 21st Century Fox to renew its bid for 100% ownership of its 39% subsidiary Sky. The company (formed from the 1990 merger with British Satellite Broadcasting and the acquisition of Sky Deutschland and Sky Italia in 2014) is Europe’s largest media group and pay-TV broadcaster, with 21m subscribers and 30,000 employees. Murdoch’s 2011 bid for ownership of what is the world’s most profitable TV group was aborted amid the UK’s phone hacking scandals. It led to the separation of News Corp (newspapers, books and online) from 21st Century Fox (TV and movies).

With the de-merger (and the end of most UK litigation) there seems no reason why a deal would not be permitted – albeit with some predictable political noise. Only the involvement of News Corp in the new takeover bid (where its separation should strengthen the case for approval) – or some fresh evidence implicating the Murdoch family in the previous scandals – can prevent the pan-European Sky network becoming wholly-owned by 21st Century Fox by 2017. Then, it can push ahead with a global strategy.

The politics of the deal could be smoothed by any change of ownership of ITV and Channel 4 (coveted variously by Vivendi, BT, Disney, and Virgin Media/ Liberty Global). Channel 5 (owned by Viacom) is somewhere in the mix, waiting to be involved.

The UK government’s counter-intuitive launch of a network of local TV broadcasters (including the Lebedev family’s London Live) may start to unravel as the existing stations merge, go online-only, and/or form partnerships with regional newspapers.

Predictions: ITV will be sold to Vivendi, BT, Viacom, Liberty or Disney. Fox will become 100% owner of Sky in 1916-17.

Time for ‘media-tech’

So, we predict 2016 will be the year of media partnerships. M&A has always been a part of strategy. But we have arrived at the point where so much traditional media is self-evidently losing the fight against digital disruption. Before it is too late, these companies need to understand what is really happening at the Washington Post. Jeff Bezos is, of course, applying to the news business his skills and experience, as one of the world’s most successful digital entrepreneurs. But his hundreds of tech recruits underline the extent to which this is not just another billionaire with a trophy asset. It’s become a ‘partnership’ between news media and the tech business (“media-tech”) which could be the reinvention model for traditional media everywhere.

This new reality creates unmistakeable opportunities for digital entrepreneurs to exploit what are often still powerful – and profitable –

brands. Newspaper arrivistes Jeff Bezos and Alibaba’s Jack Ma are the poster boys for media-tech. But there will be many others. Could the fight for global news leadership see some kind of combination of CNN, newspaper brands, and digital services like Huffington Post, BuzzFeed or Vox? Could Britain’s free-to-air broadcaster ITV find a future in combination with, say, Time Warner or even Netflix? Could Business Insider (now owned by Axel Springer) link with a broadcaster to pitch for leadership in global business TV?

This is the time for partnerships not merely acquisitions. Corporate acquisitions routinely fail either because the wrong person bought them or the wrong person managed them. Now, traditional media companies must use deals to change completely how they look, think and act. If they do, their portfolios of famous brands, distinctive content and large audiences will (again) start to count for something.

That means, at the very least, an infusion of new digital talent in the upper echelons of traditional news brands.

The opportunity is crystal clear in the news business where – for all the digital innovation – most companies are still managed by newspaper people. But it also applies elsewhere. B2B media will increasingly be dominated by single-sector, narrow-but-deep specialists – whether as solo companies or multi-sector groups. They must be versatile enough to exploit a wide range of information, events, marketing and professional services – and globally. B2B brands should consider joint ventures, alliances or affiliate networks, not least with non-media owners of high-value statistical information and services like research and consulting. And the same case can be made for specialist consumer media.

The fact is that partnerships can provide the people and insights to rejuvenate disrupted media companies. And that requires executives to manage some pivotal acquisitions as mergers or even reverse takeovers (whatever the actual deal structure). It’s time.

Context: have you read these?

The Bezos lessons for daily newspapers

Why newspapers must dare NOT to be daily

Can dailies compete in global news?

Is Immediate becoming a retailer?

Journalists who are revolutionising news